Singapore’s New Buyer’s Stamp Duty Rates: What You Need to Know

To increase the progressivity of the Buyer 8217 s Stamp

To increase the progressivity of the Buyer’s Stamp Duty (BSD) regime in Singapore, Lawrence Wong, the Minister for Finance, during the Budget Statement for 2023, announced an increase in the top marginal BSD rates for residential properties as well as non-residential properties.

These changes came into effect on Feb 15 2023, and are expected to impact 15% of residential and 60% of non-residential properties.

The increase in top marginal BSD rates for residential and non-residential properties is projected to generate approximately $500 million in additional annual revenue. However, the actual revenue generated may vary depending on the condition of the property market.

This article overviews the critical changes to BSD rates in the new measures.

The Buyer’s Stamp Duty (BSD) is calculated based on the higher value of either the purchase price or the property’s market value.

As of Feb 15, 2023, the maximum BSD rate for residential properties has been increased to 6%, while the maximum BSD rate for non-residential properties is now 5%.

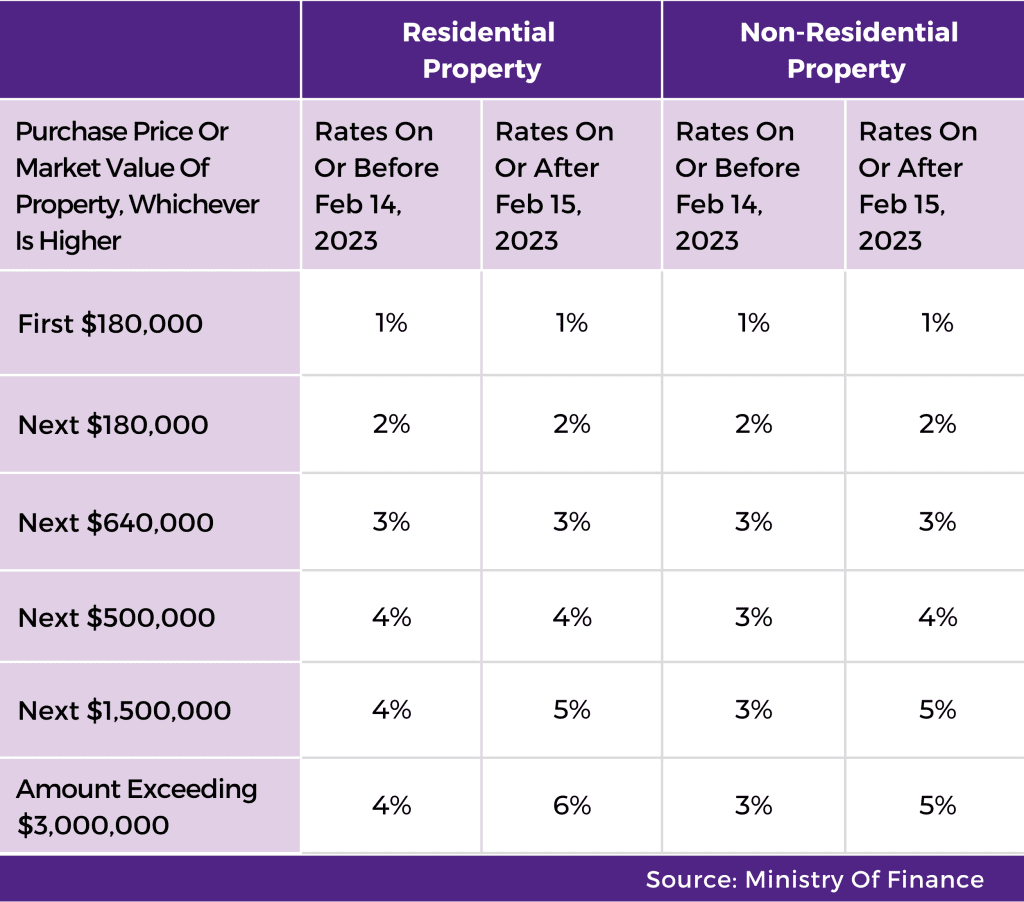

The table below exhibits previous and revised Marginal BSD rates:

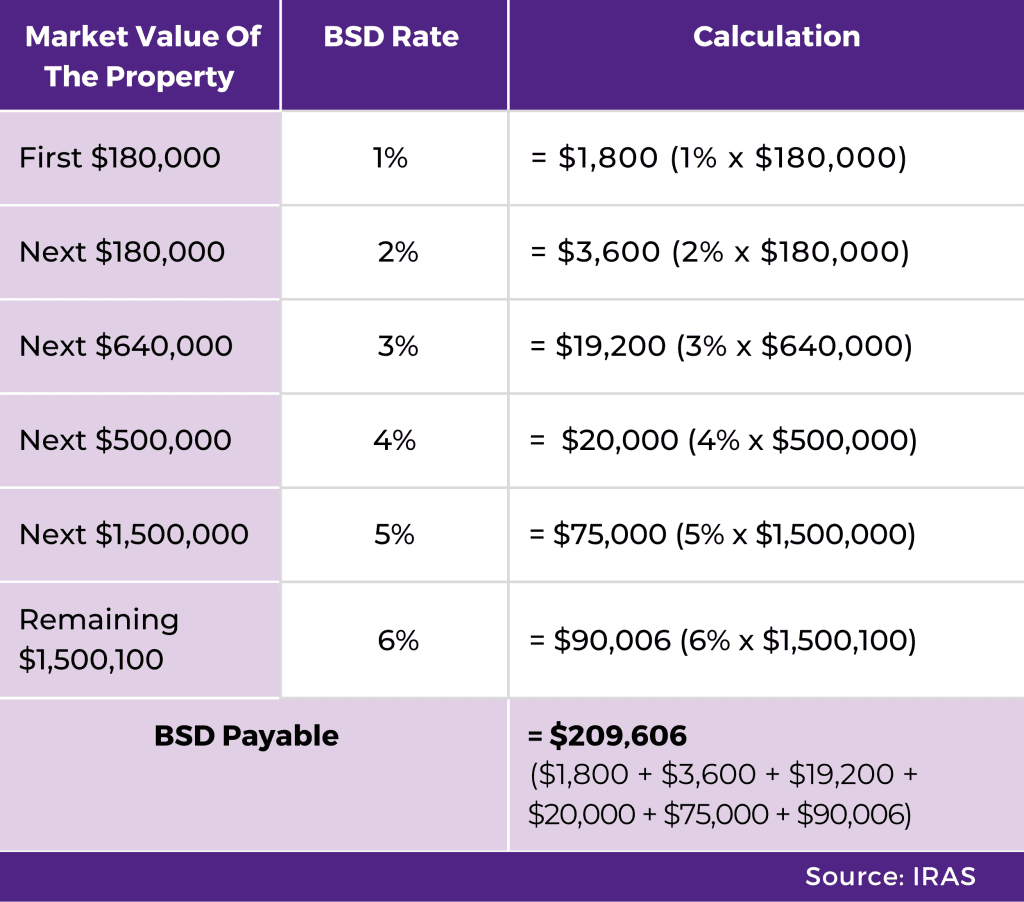

Here is an example illustrating the computation of BSD:

A terrace house was purchased on Feb 17 2023 at $4,500,100, which is reflective of the market value

The provision stipulates that the old BSD rates will apply to cases meeting the following conditions:

(i) the Option to Purchase (OTP) must have been granted by sellers to potential buyers on or before Feb 14 2023

ii) the OTP must be exercised on or before Mar 7 2023, or within the OTP validity period, and the OTP must not have been varied on or after Feb 15 2023.

It is important to note that for stamp duty purposes, the OTP is considered exercised when the Acceptance of OTP or the Sale and Purchase Agreement, whichever is applicable, is executed or signed by the buyer.

If you’re buying a property for $1.5 million or less (for a residential property) or $1 million or less (for a commercial property), this new rule doesn’t apply to you. In other words, you’ll still pay the same stamp duty as before.

The government of Singapore offers a Buyer’s Stamp Duty (BSD) remission for acquiring residential land with certain use restrictions or for 100% non-residential development.

The remission is the difference between the BSD rates for residential and non-residential properties.

This proposal is for the Buyer’s Stamp Duty (BSD) remission for a property restricted from residential use or development.

If the remission is granted, the non-residential BSD rates will be applied to the entire property or the portion restricted from residential use.

To qualify for remission, the following conditions must be met:

In summary, the remission allows for a lower non-residential BSD rate to be applied to a property that is restricted from residential use, provided that a certain percentage of the GFA is used for non-residential purposes and that no portion of the GFA designated for non-residential use is subsequently used for residential purposes. If these conditions are not met, the remitted BSD amount must be paid back to the government.

If you buy residential land without any use restrictions and want to build a 100% non-residential development, you may be eligible for remission of the Buyer’s Stamp Duty (BSD) rates for residential properties, subject to the following conditions:

If you buy residential land and want to build a non-residential development, you may be eligible for a lower BSD rate.

However, you must not use the property for residential purposes and must inform the IRAS if you do so in the future. You must also submit the required documents to the IRAS and pay back the remitted BSD if you use the property for residential purposes or if regulatory approval is granted for residential units.

In conclusion, the new changes to the Buyer’s Stamp Duty (BSD) rates in Singapore aim to increase the progressivity of the regime, generate additional revenue, and promote non-residential development. Property buyers must know the new rates and transitional provisions, especially for residential or non-residential properties that cost more than S$1.5 million and S$1 million, respectively. The BSD remission options are available for those who purchase residential land for non-residential development, subject to certain conditions. Property buyers are advised to seek professional advice on the new measures to understand how they affect their property purchase and stamp duty obligations.

ABSD remains payable in addition to the BSD by buyers of specific profiles.

The required supporting documents include a copy of the instrument, a copy of the Letter of Undertaking to comply with all the remission conditions, and any other documentary evidence listed within the remission conditions.

The supporting documents should be submitted to the IRAS within 14 days from the date of acquisition.

Certain conditions need to be met, such as a certain percentage of the property’s gross floor area must be used for non-residential purposes, and the same percentage of GFA must not be used for residential purposes. Also, if any portion of the GFA designated for non-residential use is subsequently used for residential purposes, the IRAS must be notified immediately.

To increase the progressivity of the Buyer 8217 s Stamp

Aligning with the objectives of Property Cooling Measures introduced by

Selling your residential property is one of the most significant